Loan against Mutual Funds

Try out the API sethere

Purpose and Functionality

The LAMF API by Finsire is designed to facilitate seamless lending operations for RBI-regulated entities by allowing the pledge, revoke, and invoke of mutual funds held by users. This API ensures a secure and efficient process for lenders and borrowers, enhancing the lending experience through streamlined interactions with mutual fund holdings.

Detailed Features of Loan against Mutual Fund (LAMF) API

The LAMF API is designed to cater to the needs of both borrowers and lenders, ensuring a seamless and transparent lending process. The dual-view approach is essential for maintaining clarity and efficiency in the loan management process. It allows borrowers to have a clear understanding of their loan status and pledged assets, while providing lenders with comprehensive tools to manage and monitor the loans effectively.

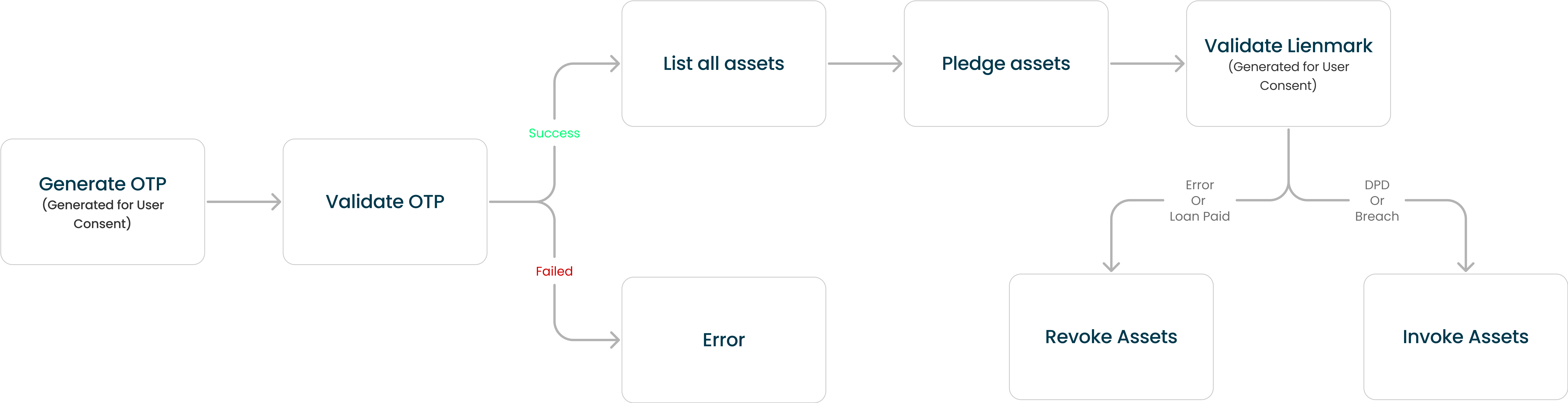

CAMS side LAMF Flow

Brokers Supporting LAMF through CAMS APIs

Mutual funds acquired through the above brokers are maintained by RTAs in physical or SOA format and can be pledged via the CAMS LAMF API. Similarly, mutual funds purchased directly from the AMC are also managed by RTAs and can be pledged accordingly.

Brokers Not Supporting LAMF through CAMS APIs

For these brokers, CAMS LAMF API won't work as they predominantly store mutual funds in a Dematerialization format. For mutual funds bought through these brokers, one can pledge them through the NSDL/CDSL route.

User Journey for CAMS LAMF API

User Side Functionality by LAMF API

The user-facing features of the LAMF API focus on providing borrowers with clear and accessible information about their loans and pledged assets. This transparency helps in building trust and ensuring that borrowers are well-informed about their financial obligations.

1. Active loans

Displays a list of active loans that the user has taken against their mutual fund holdings. This feature helps users keep track of their outstanding loans and understand their current financial commitments.

2. Units of mutual funds pledged

Shows detailed information about the mutual fund units that have been pledged as collateral for the loans. This includes the specific mutual funds, the number of units, and their current value.

3. Payment history

Provides a comprehensive history of payments made towards the loans. Users can see details of each payment, including dates, amounts, and the remaining balance. This helps in maintaining transparency and allows users to keep track of their repayment progress.

Lender Side Functionality by LAMF API

The lender-facing features of the LAMF API are designed to provide lenders with the tools they need to manage and monitor loans effectively. This includes detailed loan information, payment tracking, and the ability to take actions based on loan status.

1. Consolidated dashboard view

Lenders can access a comprehensive dashboard that consolidates all the loans they have disbursed. This view provides an overview of the total loans, outstanding amounts, and other key metrics, enabling lenders to manage their loan portfolios efficiently.

2. Individual Loan Details

Provides detailed information on each loan taken by users. Lenders can view specifics such as the mutual funds pledged, the loan amounts, interest rates, and terms. This detailed view helps lenders in assessing the risk and managing individual loans effectively.

3. Schedule and Pending Payments

Enables lenders to schedule payments and track pending payments from borrowers. This feature ensures that lenders can manage their cash flow effectively and take necessary actions in case of delayed or missed payments.

AMCs Linked with CAMS

Benefits and Rationale of the LAMF API System

The Loan Against Mutual Fund (LAMF) API system by Finsire is designed to enhance the efficiency, security, and transparency of lending operations involving mutual funds. Here’s why this system is essential and the benefits it provides:

1. Maker-Checker System for Automated and Manual Processes

The LAMF API incorporates a maker-checker system, which is a dual-layered process involving both automated and manual verifications. This approach ensures robust security and accuracy in lending operations.

- Automated Processes: Automations handle routine and repetitive tasks, such as OTP generation and validation, fetching mutual fund details, and updating loan status. This reduces human error and speeds up the process.

- Manual Checks: Certain critical actions, like invoking or revoking pledges, involve manual verification to ensure compliance with regulatory standards and to handle exceptions. This combination of automation and manual checks ensures that the system is both efficient and secure.

2. Security

Security is a paramount concern in financial transactions, and the LAMF API system addresses this through multiple layers of protection.

- Data Security: User data, including mutual fund details and personal information, is securely transmitted and stored, ensuring confidentiality and protection against breaches.

- Authorization and Consent: The use of OTPs for authorization ensures that only the legitimate user can access and pledge their mutual fund assets, preventing unauthorised actions.

- Lien Marking: The lien-marking process ensures that the pledged assets are legally secured under the lender’s name, providing a clear claim in case of defaults.

3. In-house Loan-to-Value (LTV) Model

Finsire’s in-house LTV model plays a crucial role in maintaining a balanced and prudent lending approach.

Accurate Valuation: The model calculates the current value of the pledged mutual funds, considering factors like NAV (Net Asset Value) and market conditions. This ensures that the valuation is accurate and up-to-date.

- Balanced Lending: By suggesting a balanced LTV ratio, the model helps lenders determine the appropriate loan amount against the pledged assets. This prevents over-leveraging and reduces the risk of defaults.

- Risk Management: The LTV model allows lenders to manage risk effectively by ensuring that the loan amount does not exceed a certain percentage of the asset’s value, providing a buffer against market fluctuations.

Requires license from Reserve Bank of India (RBI). Check out for more info

Try out the API here

Updated 4 months ago