Net Worth: Assets

Try out the API here

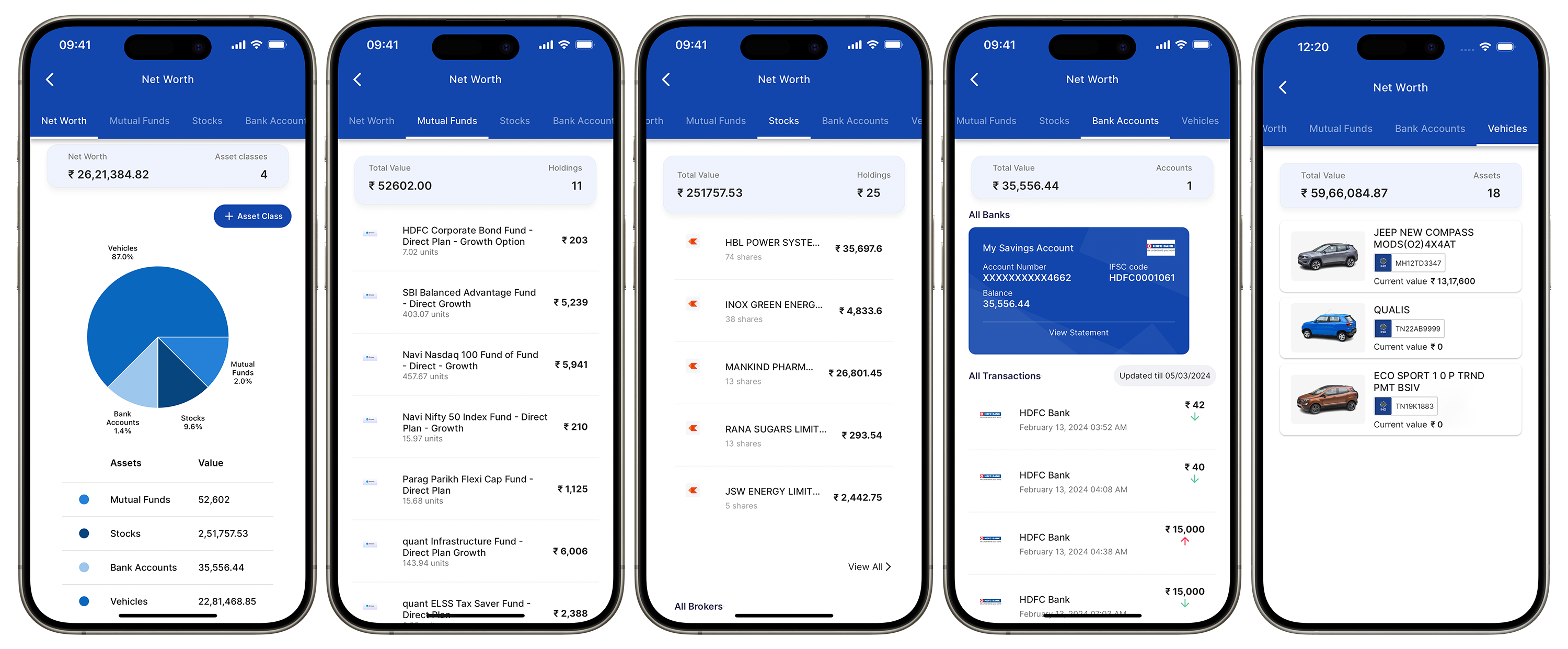

The Net Worth API is designed to provide a consolidated view of an individual's financial position by integrating and summarizing data from various asset categories such as bank accounts, stocks, mutual funds, and vehicles.

Net Worth API offers a detailed breakdown of each asset class, illustrating both the current value and its proportion in the overall financial mix. This API is a powerful tool for anyone needing a comprehensive, real-time snapshot of financial health, enabling effective management and strategic planning.

Detailed Features of the Net WorthAPI

The Net Worth API showcases a variety of detailed features across multiple financial sectors, as illustrated in the provided images. Each feature plays a crucial role in providing a holistic view of an individual’s financial status:

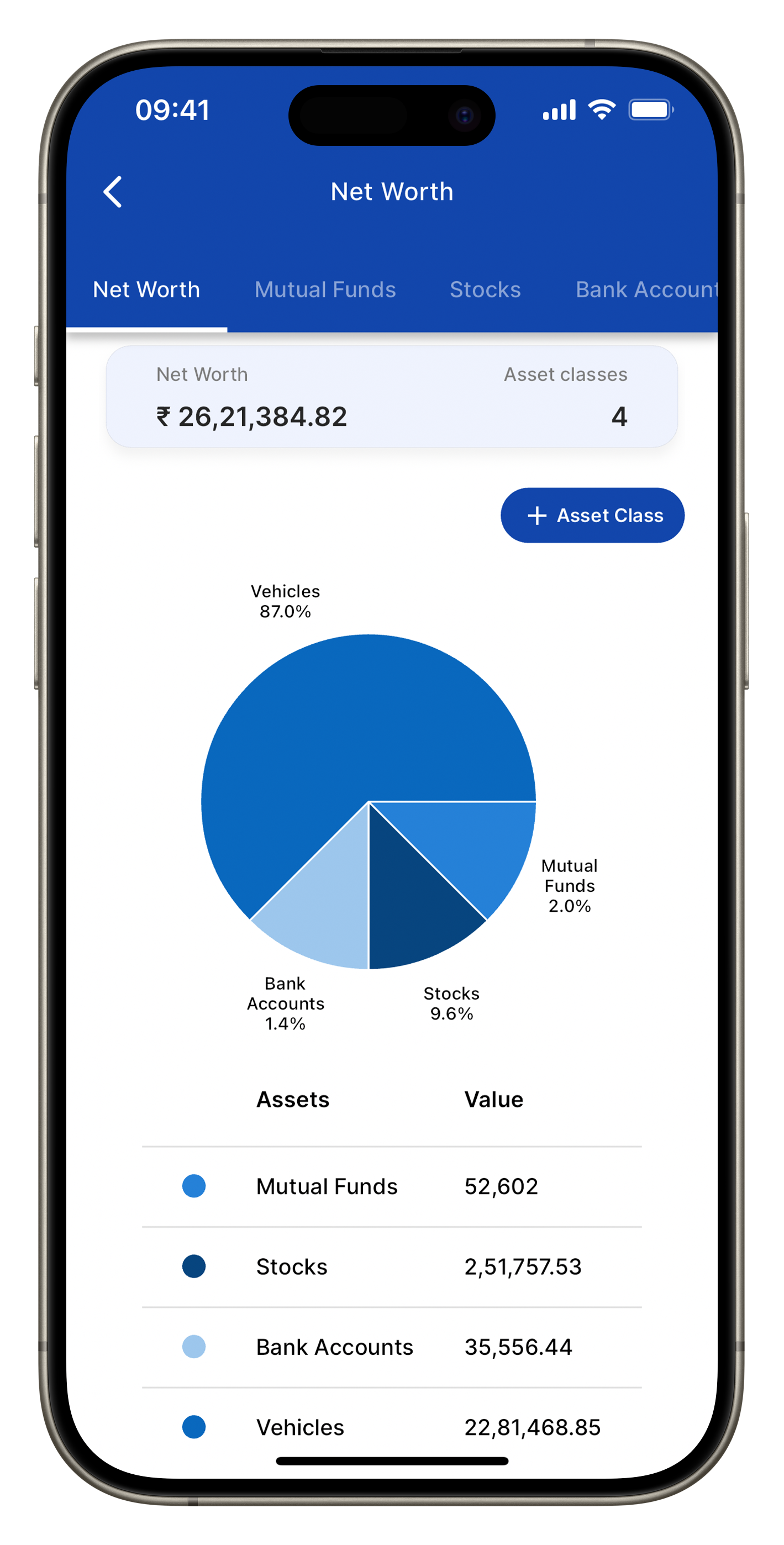

- Asset Distribution Overview

- Pie chart visualization: A visual representation of asset allocation is displayed through a pie chart, showing the percentage distribution among different asset classes such as vehicles, stocks, and mutual funds. This helps in understanding the diversification of assets at a glance.

- Asset class summary: Each asset class is summarized by its total value, providing clear insights into where the majority of the user's net worth is invested.

User view of Networth

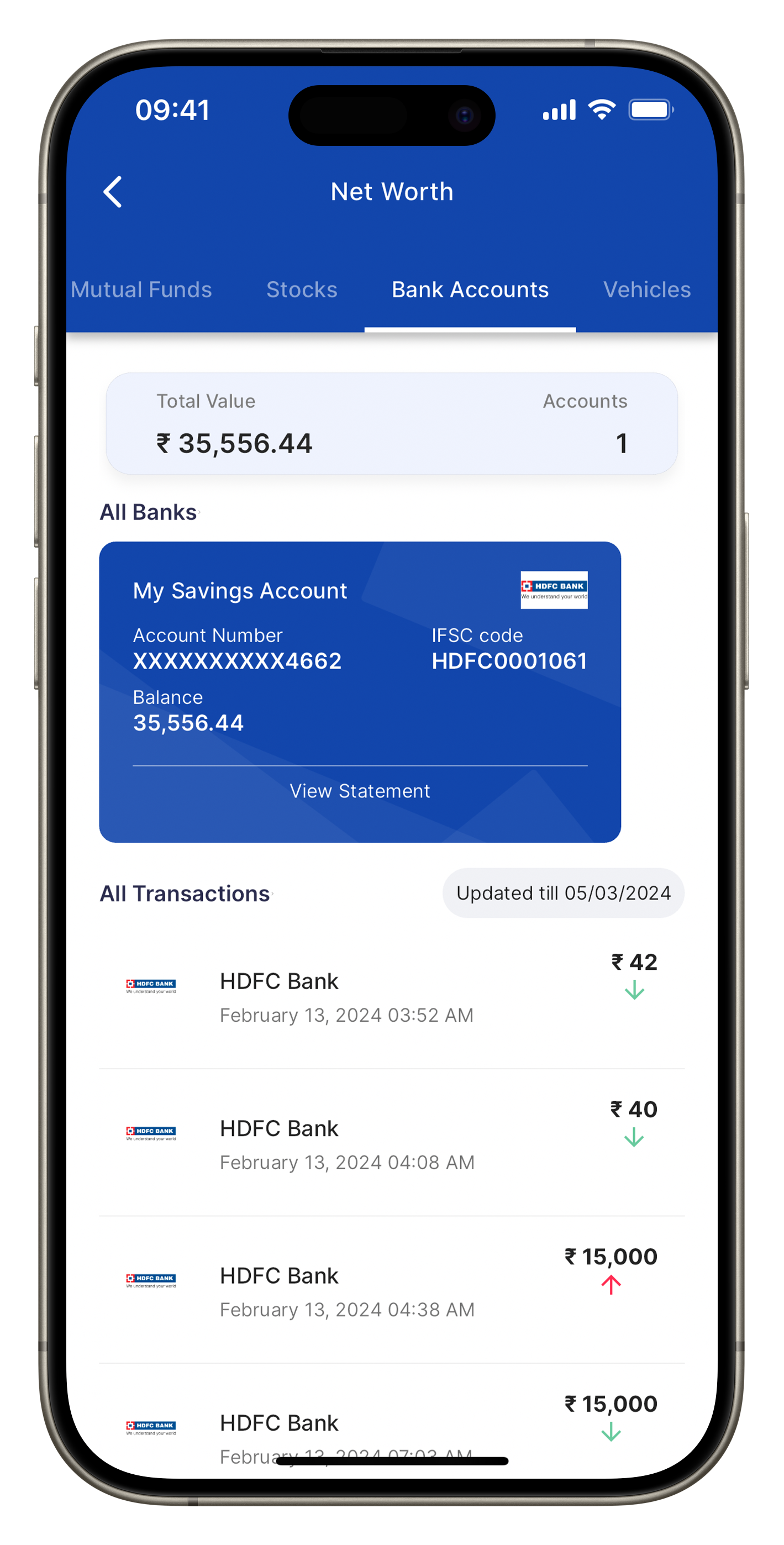

- Bank Account Management

- Total value display: The API provides a quick snapshot of the total value held in the user's bank accounts, offering an immediate overview of liquid assets.

- Detailed account information: Each bank account can be individually examined, showing the account balance, account number, and IFSC code, which can be critical for transactions and account management.

Transaction history: There is an updated list of all recent transactions made through the account, including timestamps and amounts, allowing users to track their spending and deposits closely.

User View for Bank Statements

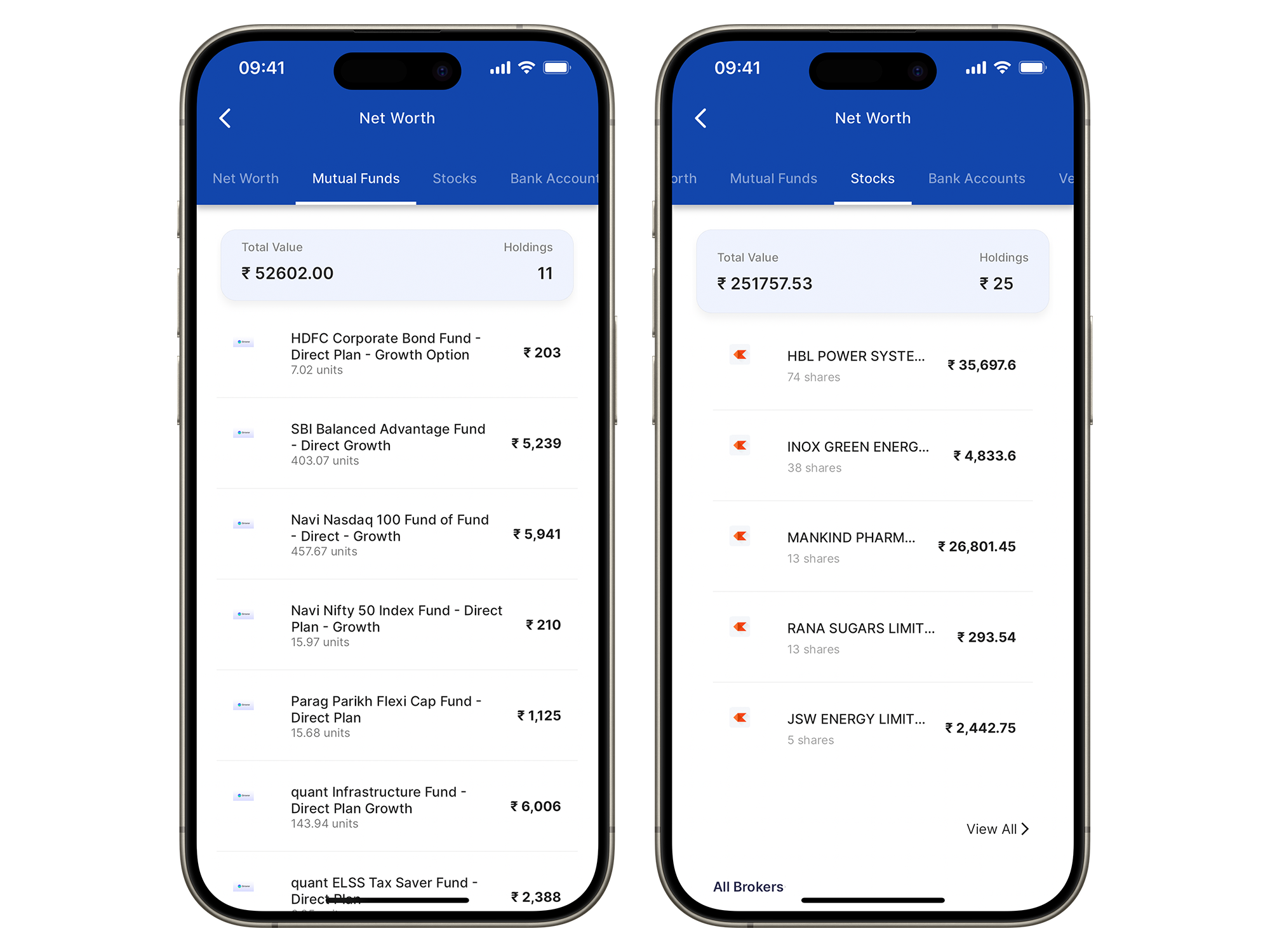

- Investment Details

- Mutual funds and stocks: Detailed information on holdings within mutual funds and stocks, including the number of units and current market value of each investment. This feature is essential for investors to monitor the performance and value of their investments.

- Investment allocation: A breakdown of investments showing how many holdings are in each fund or stock, allowing users to assess their investment spread and make informed decisions based on current market values.

User View of Stocks and Mutual funds details

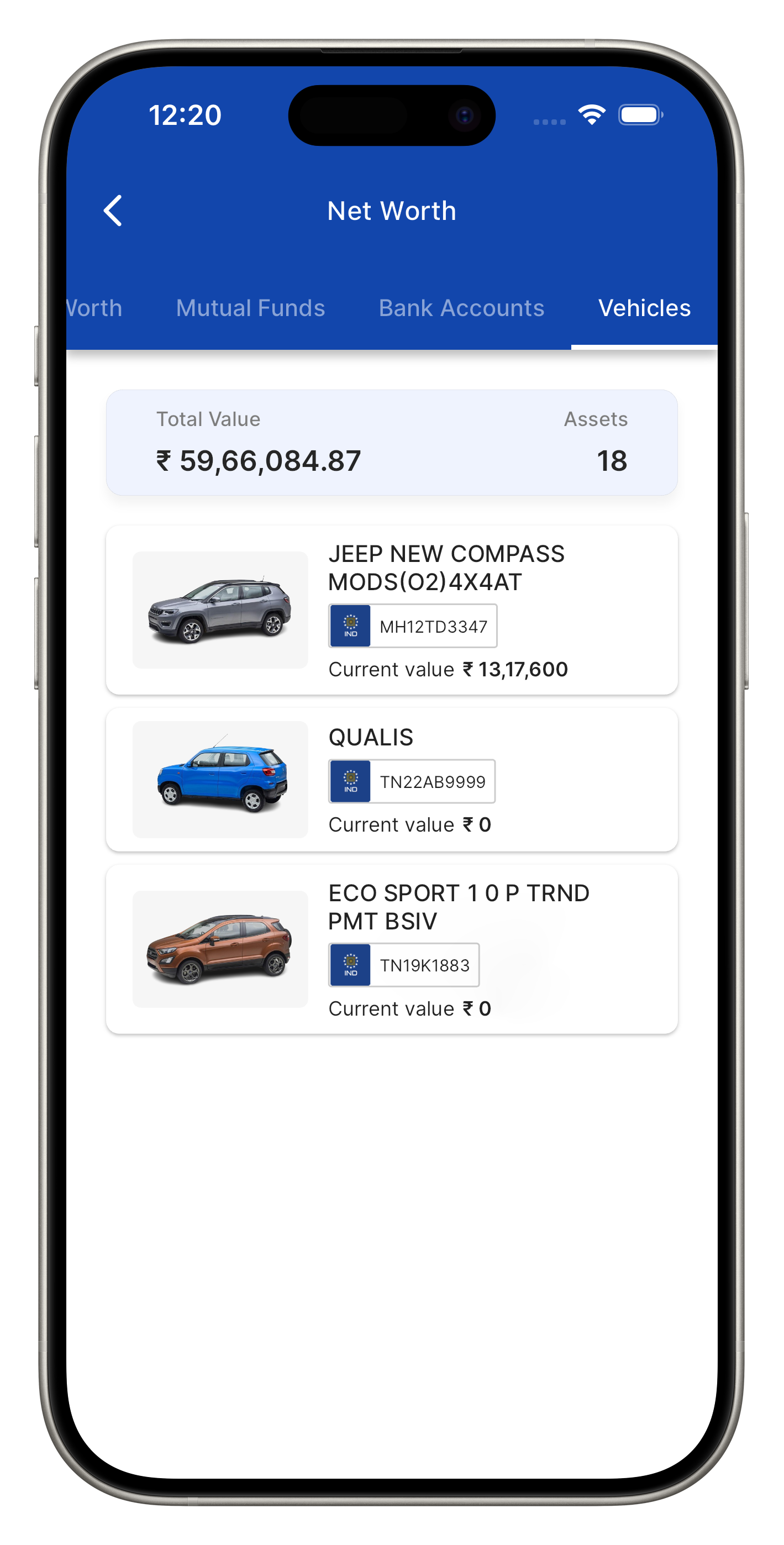

- Vehicle Holdings

- Vehicle information: The API provides current values and details for vehicles owned, which is part of the overall asset calculation. This includes the make, model, and registration details of each vehicle.

User view of Vehicles holdings

- Comprehensive Net Worth Calculation

- Total asset calculation: All assets are totaled to present a net worth figure, giving users a precise figure of their overall financial worth. This is particularly useful for financial planning, loan applications, or any financial assessment processes.

User screens for comprehensive Networth

Inputs for the Net WorthAPI

The Net Worth API requires specific inputs to provide a detailed and comprehensive output of an individual's net worth, encompassing both digital and physical assets. Understanding these inputs is crucial for correctly leveraging the API to get accurate and relevant financial data. Here’s a detailed breakdown of each input category:

- Mobile Number & OTP

- Purpose: Identification and fetching of digital assets.

- License required - Regulated by RBI, SEBI, PFRDA, IRDAI entities can consume AA data.

- Description: Mobile number serves as unique identifier for the user and to identify their digital assets like Bank Account Statements, Mutual funds, Stocks, Bonds, and other digital assets that are deposited with different repositories, we fetch this data with user's consent as an OTP.\

- Vehicle Registration Number (RC No.)

- Purpose: Identification of vehicle assets.

- No license required

- Description: This input is used to fetch details about the vehicles owned by the user, including make, model, year, and current market value. This information contributes to the overall asset value calculation in the net worth summary.

- Real Estate Area and Pin code

- Purpose: Localization and valuation of real estate properties.

- No license required

- Description: Inputting the area and pin code where the property is located allows the API to assess the property's value based on current market trends and geographic specifics. This data is essential for accurately reflecting the value of real estate holdings in the user's total net worth.

Broad applications of the Net WorthAPI

The Net Worth API serves a variety of users, each leveraging its capabilities in unique ways to enhance financial management, decision-making, and service delivery. Here’s a detailed look at how different groups can benefit from this API:

Banks and NBFCs can utilize the Net Worth API for better risk management and lending decisions:

- Credit scoring: Better assess a borrower’s creditworthiness by having a holistic view of their financial health beyond just income statements.

- Loan customization: Tailor loan offerings are based on detailed insights into an applicant's total assets, ensuring terms that are favorable for both the lender and borrower.

Wealth management services: Banks can use this tool to offer wealth management and advisory services, attracting a higher net worth clientele.

Technology companies in the financial sector can integrate the Net Worth API to build or enhance applications, providing added value to their users:

- Feature-rich applications: Incorporate net worth tracking and analysis features into personal finance apps, enhancing user engagement and satisfaction.

Automated financial planning tools: Develop or improve automated tools that can suggest financial decisions based on changes in net worth. - User retention: By offering comprehensive financial solutions, FinTechs can increase user retention and stand out in a crowded market.

Financial advisors find the Net Worth API especially useful for managing multiple clients efficiently:

- Tailored advice: Advisors can offer personalized advice based on up-to-date, detailed financial data of clients’ portfolios.

- Risk assessment: By understanding the asset allocation and diversification of a client's portfolio, advisors can better assess risk and recommend adjustments.

- Enhanced service offering: Real-time financial data integration allows advisors to provide proactive service, alerting clients to opportunities or risks promptly.

Large corporations can use the Net Worth API for:

- Employee financial wellness programs: Incorporate the API into platforms that help employees manage their finances, contributing to overall job satisfaction and productivity.

- Executive compensation planning: Understand the full scope of an executive’s financial portfolio to design compensation packages that are both competitive and fiscally responsible.

Input Type

| Input | Type | Description |

|---|---|---|

| finsire_id | string | A valid id generated during user creation |

Common Error Scenarios

The following are the common error scenarios in sending an API request:

| Error | Description |

|---|---|

| param is missing or the value is empty: finsire_id | finsire_id is a required field |

You can try out this API here.

Updated 3 months ago