Overview

Whether it's applying for a loan, tracking your investments, or getting insurance, everything is at your fingertips. This is not a distant dream but a reality being shaped by the Account Aggregator (AA) system in India.

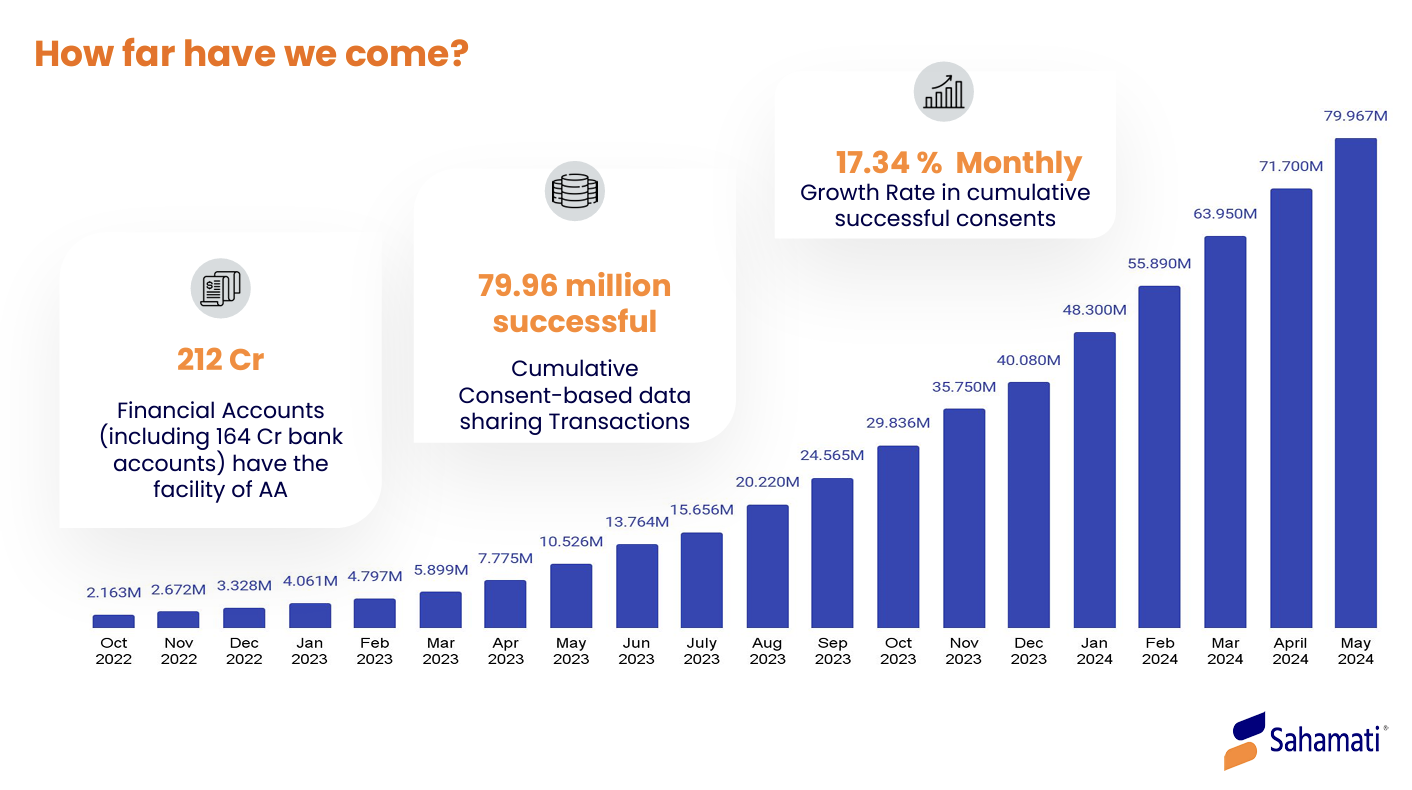

Growth and Adoption

The adoption of the AA system has been rapid and promising. Since its public launch in August 2021, the number of linked accounts and consent requests has been growing exponentially. As of now, millions of accounts have been linked through AAs, with a consistent month-on-month growth rate of over 22%. The system's early adoption has been impressive, with over 76 million accounts. Financial institutions and fintech companies have quickly embraced the AA framework to streamline their services and enhance user experience.

Comprehensive Data Fetching Capabilities of Account Aggregators

The Account Aggregator (AA) framework in India has revolutionised how financial data is accessed and shared, allowing for a comprehensive and structured flow of information between financial entities. This system is backed by multiple regulators and covers a broad spectrum of financial instruments.

Here's a detailed look at the different types of data that can be fetched using AAs.

Data Types and Their Regulatory Oversight

Banking Data (RBI)

- Savings Accounts: Information about individual savings accounts, such as balance and transaction history.

- Current Accounts: Data pertaining to sole proprietorship current accounts, useful for business transactions.

- Fixed Deposits: Details about fixed deposit accounts, including maturity dates and interest rates.

- Recurring Deposits: Information on recurring deposit schemes, helping users track their periodic savings.

- Commercial Paper: Proposed data type that includes short-term debt instruments.

- Certificates of Deposit: Data on time deposits issued by banks, not yet live.

- Government Securities: Information on bonds and other securities issued by the government, proposed but not yet active.

Investment Data (SEBI)

- Systematic Investment Plans (SIPs): Regular investment data in mutual funds.

- Equities: Information on stock holdings and transactions.

- Alternative Investment Funds (AIFs): Data on private equity, venture capital, and hedge funds.

- Mutual Funds: Comprehensive details on mutual fund investments.

- Exchange-Traded Funds (ETFs): Data on ETF holdings and performance.

- AIF Units: Specific information on Alternative Investment Fund units.

- Infrastructure Investment Trusts (InvITs): Data on investments in infrastructure trusts.

- Real Estate Investment Trusts (REITs): Information on investments in real estate trusts.

- Bonds and Debentures: Proposed data types include various bonds and debentures, though not yet live.

Tax Data (Department of Revenue)

- Goods and Services Tax (GST) Returns: Crucial for businesses to track their tax filings and liabilities. This is a significant addition that simplifies tax compliance.

Insurance Data (IRDAI)

- Insurance Policies: Details about life, health, and general insurance policies, enabling users to keep track of their coverage and premium payments.

Pension and Provident Fund Data (PFRDA)

- National Pension Scheme (NPS) Balances: Data on contributions and balances under the NPS.

Definition and Roles of AAs, FIPs, and FIUs

To grasp the functionality of the Account Aggregator system, it's essential to understand the roles of the key players: Account Aggregators (AAs), Financial Information Providers (FIPs), and Financial Information Users (FIUs).

Account Aggregators (AAs):

- Definition: Account Aggregators are licensed entities regulated by the Reserve Bank of India (RBI). Their primary role is to facilitate the secure and efficient transfer of financial data from FIPs to FIUs with the explicit consent of the user.

- Role: AAs act as intermediaries that manage the consent process and ensure that financial data is shared only with the user’s permission. They cannot read or store the data themselves; they merely transport it from the source to the requester.

- Example: Think of an AA as a digital courier service. Just as a courier ensures that your package reaches its destination securely, an AA ensures your financial data reaches the intended recipient without any breach of privacy.

Financial Information Providers (FIPs):

- Definition: FIPs are entities that hold a user's financial data. This can include banks, insurance companies, mutual fund houses, pension funds, and other financial institutions.

- Role: FIPs supply the requested financial data to AAs once they receive a valid consent request from the user.

- Example: Your bank, which holds details about your savings and transactions, is an FIP. When you need to share your bank statements with a loan provider, the bank (FIP) supplies this information through the AA system.

Financial Information Users (FIUs):

- Definition: FIUs are entities that need access to a user’s financial data to provide services. These can be lenders, financial advisors, insurance companies, or any other financial service providers.

- Role: FIUs request data from AAs to assess a user’s financial health and offer appropriate services.

- Example: A loan provider (FIU) needs to evaluate your creditworthiness. They use the AA system to request your financial data, such as bank statements and income details, to make an informed decision.

Requires license from : Reserve Bank of India (RBI) / Securities and Exchange Board of India (SEBI) / Pension Fund Regulatory and Development Authority (PFRDA) / Insurance Regulatory and Development Authority (IRDAI). Check out for more info

Note:We're working towards providing more wrapper APIs with other Account Aggregators as well. If you have a specific AA in mind and we're currently not live with them, please reach out to us here or mail us at [email protected]

Updated 3 months ago